Description

Gain a competitive edge with GlobalData’s Oman Cards and Payments Market Analysis Report, covering detailed insights on transaction growth, payment usage trends, regulatory changes, and digital payment innovation to guide smarter product, strategy, and investment decisions in Oman’s fast-evolving payments ecosystem.

Built on GlobalData’s proprietary financial services intelligence platform, and trusted by leading banks, fintechs and governments, this report combines rigorous data analysis and sector expertise to support your competitive positioning with confidence.

What you’ll find in our Oman Cards and Payments Market report

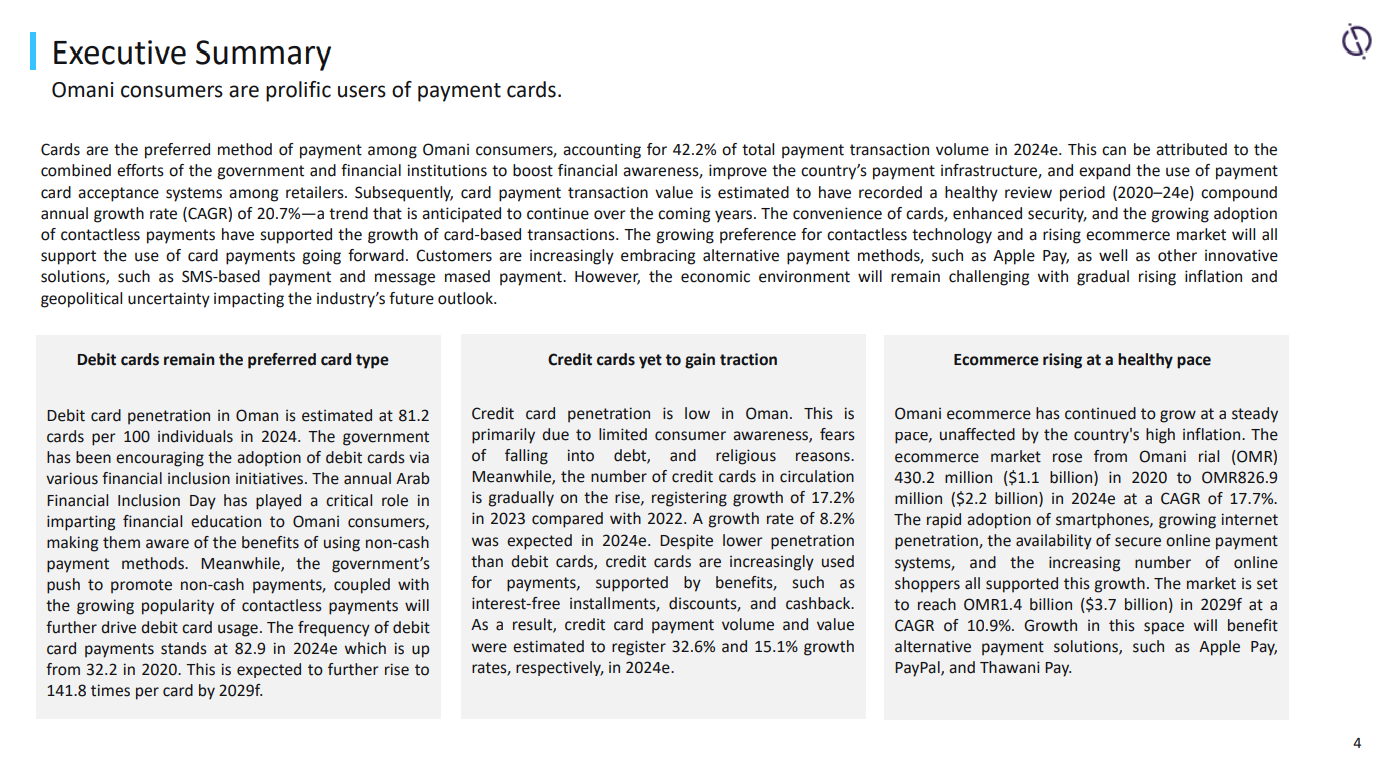

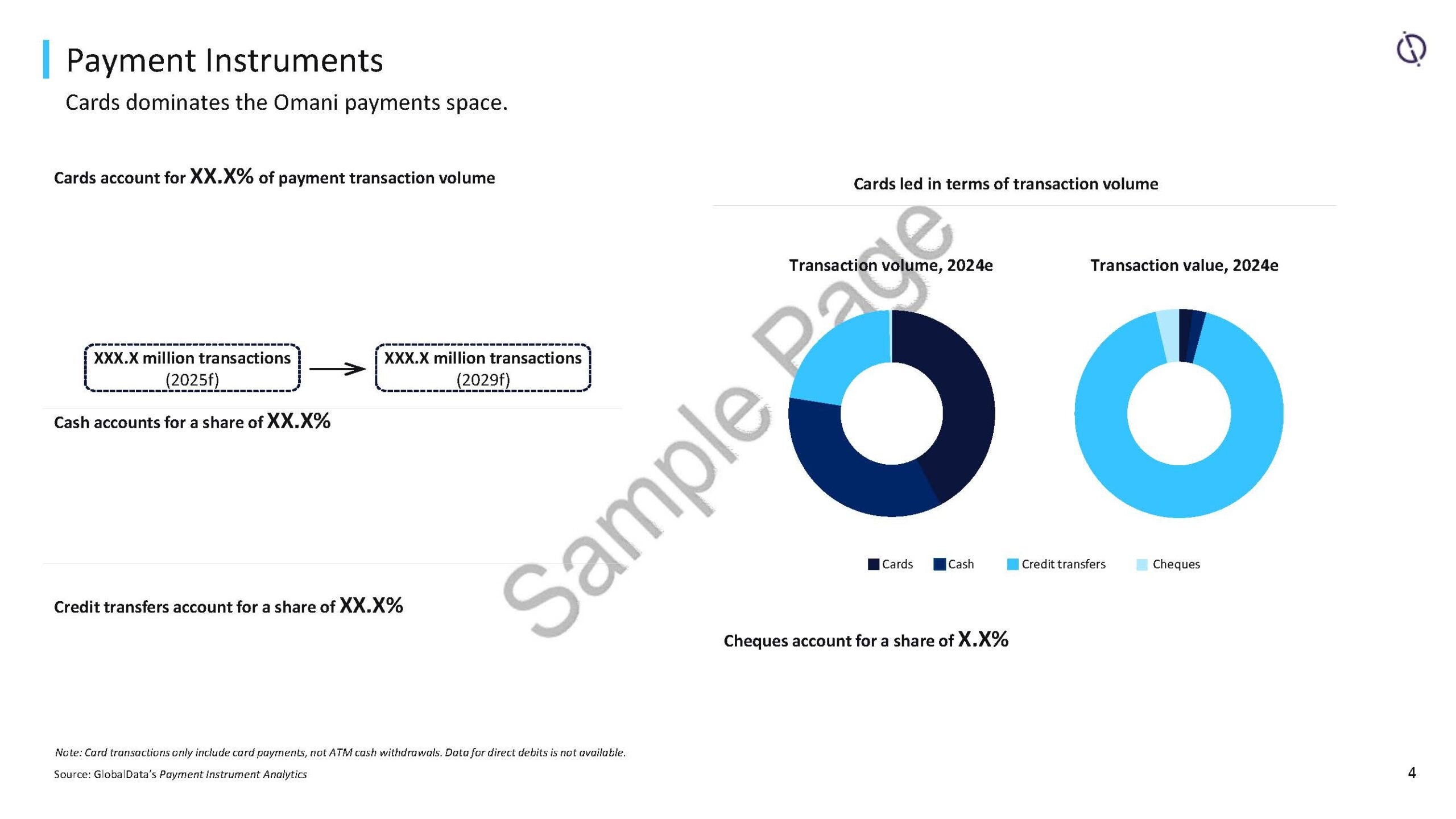

- Market Size & Transaction Growth: Insights into the value and volume of card payments, growth rates and adoption trends in Oman.

- Payment Types & Channel Mix: Examination of credit, debit and prepaid cards along with digital wallets, contactless payments and online payment channels.

- Regulatory & Policy Landscape: Analysis of the laws, regulations and initiatives shaping payments innovation and consumer protection in Oman.

- Competitive Environment: Profiles of key issuers, acquirers, processors and fintechs operating in the cards and payments ecosystem.

- Technological Innovation & Security: Exploration of mobile payments, security standards, fraud prevention and infrastructure developments.

- Consumer Behaviour & Demographics: Data on card ownership, usage patterns, preferences for payment methods across consumer segments.

- Challenges & Opportunities: Assessment of barriers such as regulatory constraints or infrastructure gaps and identification of growth potential areas.

Who should read this Oman Cards and Payments Market report?

This report is essential for:

- Banks, Financial Institutions & Card Issuers, wanting insight into issuer competition and card product demand

- Fintechs & Payment Gateways, looking to innovate or scale digital payment offerings

- Regulators & Government Agencies, formulating payment policy, regulation, oversight or financial inclusion strategy

- Technology Providers & Security Firms, focusing on fraud prevention, payment platforms or mobile wallet infrastructure

- Investors & Strategic Advisors, assessing growth potential, risk and return in Oman’s payments market

- Senior Executives (Product, Strategy, Payments) needing deep insight to guide product roadmaps or market entry

How you can use our Oman Cards and Payments Market report

This report helps you:

- Track current and forecast transaction volumes, growth rates and channel shifts to guide product development or investment

- Identify untapped market segments or consumer needs for credit, prepaid or digital wallets

- Align strategies with regulatory requirements and upcoming policy changes

- Benchmark your competitive positioning against major issuers, acquirers and fintechs

- Improve security, fraud prevention and payment experience through technology insights

- Evaluate opportunities for partnerships, platform investments or enhancements in payment infrastructure

For example, a bank could use this report to design a new contactless card product or partner with a fintech; a regulator may use it to shape oversight or inclusion policies; a technology provider might identify gaps in payment security or platform capabilities.

Why does this report matter now?

Oman’s payments market is evolving rapidly due to:

- Expansion of contactless POS terminals and mobile wallets across retail and banking channels

- Growth of bank account adoption driven by the Wage Protection System and payroll account initiatives

- Introduction of Apple Pay and Samsung Pay enabling in-store, online and in-app payments

- Rising consumer demand for speed, convenience and secure digital transactions

Understanding these shifts is key to unlocking growth in one of the GCC’s most dynamic payments markets. Stay ahead in Oman’s evolving cards and payments sector with instant access to forecasts, consumer insights and competitive intelligence that support smarter strategic decisions.

All the GlobalData reports are delivered in digital version.

Reviews

There are no reviews yet.