Description

Understand the future of the global surface mining equipment sector with GlobalData’s comprehensive market intelligence report. Covering fleet populations, equipment forecasts to 2030, OEM market shares and commodity demand trends, this report helps you make informed decisions in a rapidly evolving mining landscape.

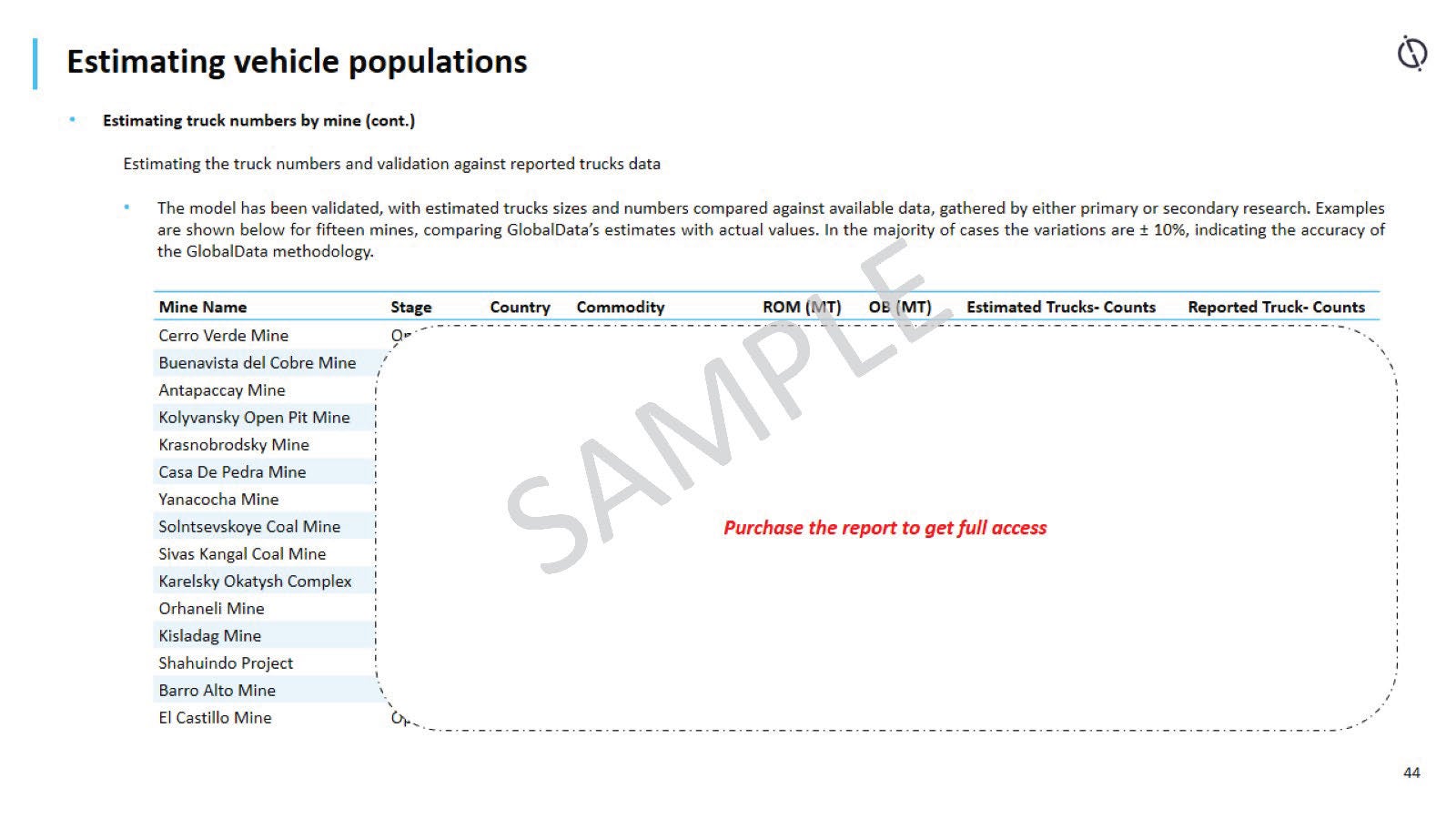

Built on GlobalData’s proprietary mining intelligence platform, and trusted by Fortune 500 companies and leading governments, this report combines data-driven insights with strategic foresight to guide your business, investment and procurement decisions.

What you’ll find in our Global Surface Mining Equipment Market report?

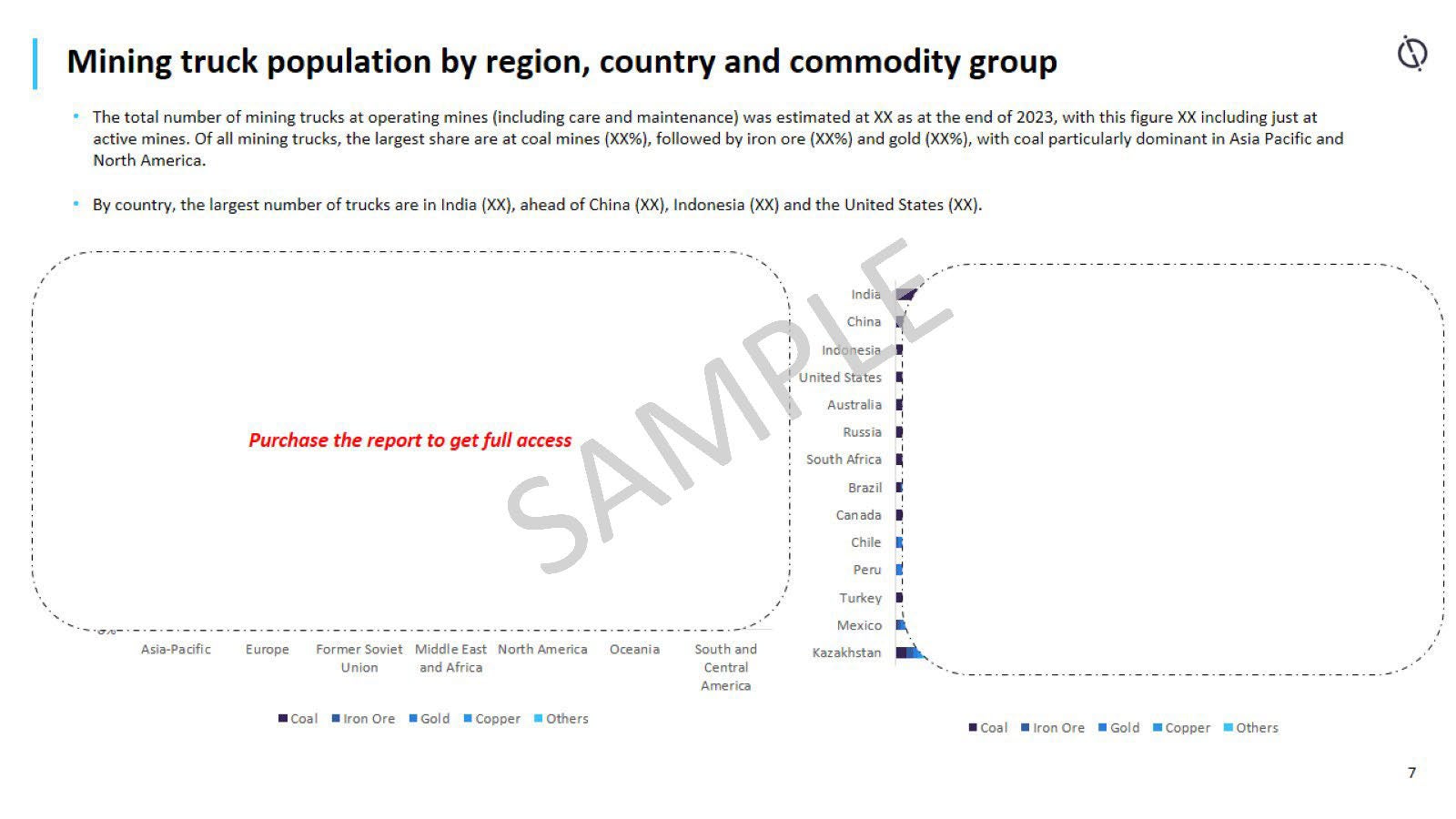

- Market Size & Growth Forecast (2024–2030): Track total and active mining equipment populations by machine type, region and country.

- Equipment Populations by Type: Trucks, hydraulic excavators, rope shovels, loaders, dozers and graders with detailed fleet counts.

- Commodity Analysis: Equipment distribution across coal, iron ore, copper and gold mining.

- OEM Market Shares: Benchmark Caterpillar, Komatsu, Liebherr, Volvo, Hitachi, BEML and Belaz by equipment type and region.

- Payload Segmentation: Analyse truck populations by payload size, including <50 tonne and 100–199 tonne ranges.

- Fleet Activity: Distinguish between total populations and active fleets at global mine sites.

- Technology Insights: Coverage of autonomous and electric mining trucks in the global fleet.

- Benchmarking Tools: Compare fleet distributions and OEM shares across major mining regions to refine strategy.

Who should read this Global Surface Mining Equipment Market report?

This report is essential for:

- Mining Operators & Contractors benchmarking equipment fleets by region, payload size and commodity exposure

- OEMs & Equipment Manufacturers tracking competitor shares and identifying growth opportunities

- Suppliers & Technology Providers assessing demand for trucks, dozers, excavators and electric or autonomous vehicles

- Investors & Financial Institutions forecasting equipment demand cycles and assessing ROI

- Government Agencies & Policymakers monitoring equipment adoption and regional fleet distribution

- Consultancies, Market Analysts & Advisors developing go-to-market, procurement and risk mitigation strategies

- Senior Executives (Strategy, Planning and Business Development Leads) driving growth, procurement and investment planning in the mining sector

How you can use our Global Surface Mining Equipment Market report?

This report helps you:

- Identify growth opportunities across equipment segments, regions and commodities

- Plan market entry or expansion with clarity on fleet growth, OEM competition and regional dynamics

- Benchmark OEM performance against Caterpillar, Komatsu, Liebherr and other global leaders

- Support procurement and investment decisions with reliable, data-backed fleet intelligence

- Develop go-to-market strategies aligned with equipment demand trends and commodity growth

- Monitor the adoption of autonomous and electric mining trucks to align product and investment strategies

For example, Caterpillar and Komatsu can benchmark their global shares in trucks and excavators. Rio Tinto and BHP may use the data to refine fleet procurement strategies. Volvo and Hitachi can track opportunities in loaders and dozers across Asia Pacific and the Americas. Investors can use forecasts to assess growth in mining equipment demand and align capital allocation strategies.

In a rapidly evolving mining equipment landscape, reliable intelligence is your competitive advantage. Equip your team with trusted insights and actionable data to drive smarter decisions on fleet planning, procurement and OEM benchmarking.

All the GlobalData reports are delivered in digital version.

Reviews

There are no reviews yet.