Description

The Saudi Arabia Projects Market Report 2025

Whether entering or expanding, the Saudi Arabia Projects Market Report 2025 gives you a complete view of the Kingdom’s $1.9tn+ project landscape, covering 2025 outlooks and future trends through 2027. Drawing on MEED’s privately gathered datasets and expert validation, it outlines market dynamics, upcoming tenders, regulatory shifts and investment flows across core sectors including construction, energy, transport and water.

What’s inside the Saudi Arabia Projects Market Report 2025?

- Detailed breakdowns of all major project sectors: oil & gas, power, petrochemicals, housing, transport and more

- Forecasts of planned investments, project pipelines and procurement plans

- Profiles of key clients and market players

- Strategic insight into investment drivers, client priorities and regulatory trends

- Risk assessments and long-term opportunity mapping in Saudi Arabia and across MENA

Opportunities Surge as Riyadh Accelerates Toward Vision 2030

In April 2016, Crown Prince Mohammed bin Salman unveiled Vision 2030, a bold blueprint to transform Saudi Arabia’s economy and society. Nearly a decade later, the Kingdom is not only on track but has exceeded several key milestones, reshaped its global reputation and unlocked unprecedented investment opportunities.

Giga Projects Enter Execution Phase

At the heart of Vision 2030 are flagship giga projects that have moved from concept to construction. These include:

- NEOM: Now home to active developments like The Line and Oxagon

- Red Sea Global: Luxury resorts and infrastructure nearing completion

- Diriyah, Qiddiya and AlUla: Cultural and entertainment hubs attracting global attention

- King Salman Park, Riyadh Sports Boulevard, and Jeddah Downtown: Urban renewal projects transforming cityscapes

In 2024 alone, giga project contracts exceeded $25 billion, contributing to a record $154 billion in total awards. In the first half of 2025 (January –June), a total of $25.7bn has been awarded, which is approximately $44.2bn less than the contracts awarded in the first half of 2024.

The slowdown in activity levels is most acute in the Saudi Giga project programme. After growing exponentially each year up to 2023 to almost $33bn, awards on the programme declined to just under $25bn in 2024 and have collapsed almost completely this year.

Sectoral Expansion Beyond Giga Projects

Saudi Arabia’s transformation isn’t limited to mega developments. Key sectors are booming:

- Oil & Gas: Saudi Aramco is investing in oil-to-chemical complexes and unconventional gas resources

- Power: The Kingdom is aggressively targeting to increase the renewable power generation portion of the total power generation

- Water: Over $15 billion contract awarded in 2024 and in 2025, over $7.9 billion already in desalination, treatment and pipeline infrastructure

- Housing: The National Housing Company is delivering 500,000 affordable homes

- Airports: Riyadh and Jeddah airports are undergoing $70 billion in upgrades

Delivery Challenges and Strategic Shifts

Despite a $1.5 trillion project pipeline, Saudi Arabia faces growing pains: cost inflation, supply chain bottlenecks and workforce constraints. To address this, Riyadh is:

- Encouraging international contractors to enter the market

- Developing super-contractors through joint ventures

- Restructuring procurement to favour partnerships over traditional contracting

New Opportunities in 2026

Saudi Arabia’s evolving construction landscape is becoming more inclusive and globally competitive. Recent reforms include:

- PPP frameworks to attract private capital

- Legislation favouring Saudi-headquartered firms

- Regional contractor development to boost local capacity

What are the advantages of the Saudi Arabia Projects Market 2025 report?

Advantages

- Visual clarity makes it easier to digest complex market dynamics at a glance.

- Unparalleled visibility into near- and mid-term opportunities.

- Connects macro trends with micro-level project action.

- Spot red flags before they impact delivery or profitability.

- Includes human-verified project data you can’t find anywhere else.

Features

- 400+ pages packed with over 250 charts, tables, maps, and project timelines.

- Detailed listings of projects due for award in 2025, 2025, and 2027, plus active execution updates.

- In-depth coverage of policy shifts, investment drivers, and regional client behavior.

- Thorough analysis of market constraints, EPC bottlenecks, and cost pressures.

- Delivered digitally via email.

Key topics from the Saudi Arabia Projects Market 2025 report:

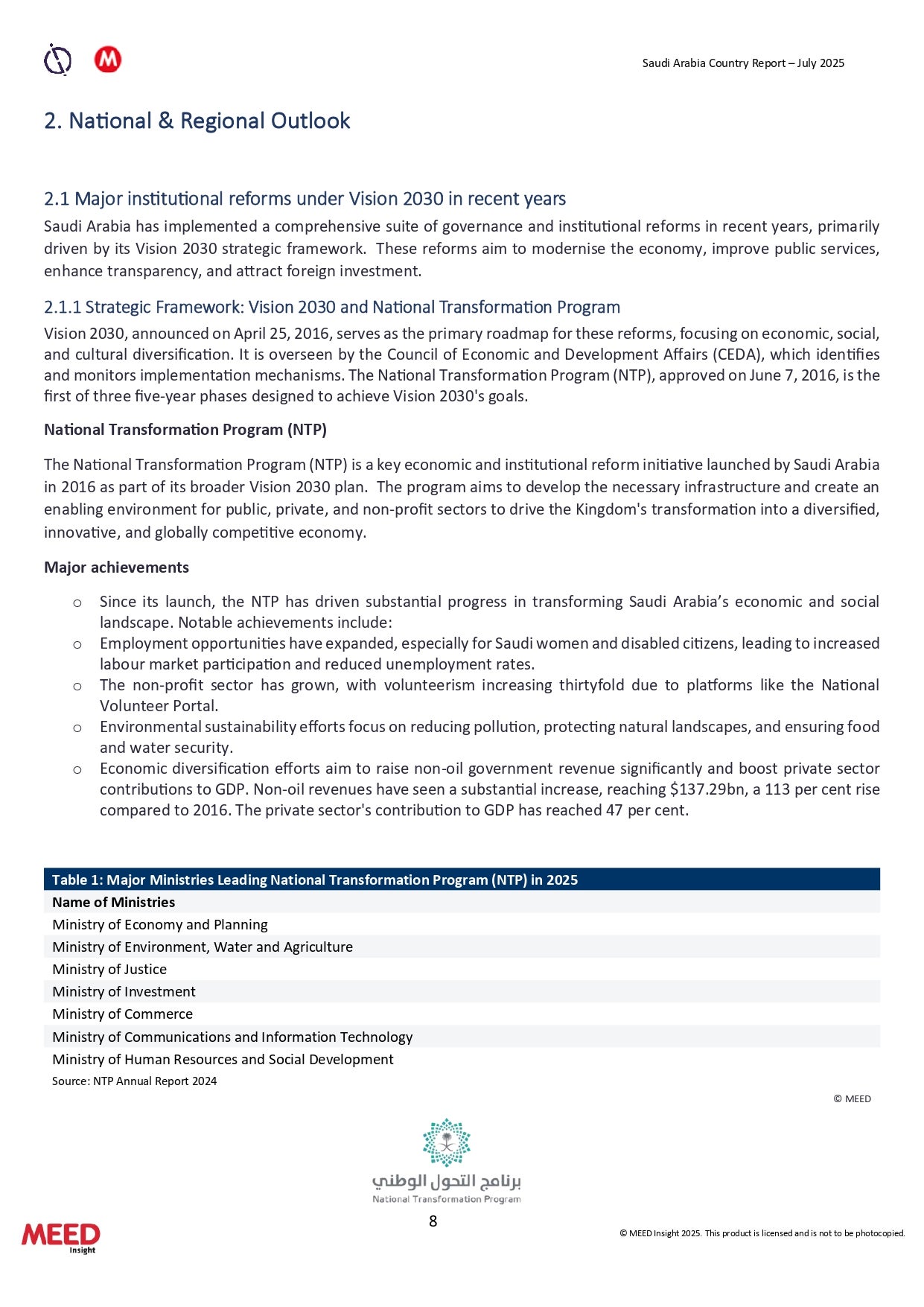

- Sector-by-sector analysis across oil & gas, petrochemicals, power, water, renewables, construction and transport

- Alignment with Vision 2030 targets, highlighting economic strategy, investment trends and policy direction

- Detailed breakdown of 14 priority sectors with high-impact projects through late 2025 and beyond

- Forecasts on capital spending, procurement plans and key client pipelines

- Identification of top contractors, leading clients and regional spending trends

- Market structure analysis, risk outlook and stakeholder insights to support strategic planning

- Powered by exclusive MEED Projects data for high-confidence intelligence

How is this report different from the earlier version?

This latest edition delivers a major upgrade with fresh data, exclusive updates and sharper insights into Saudi Arabia’s fast-evolving projects market. The insights combine MEED’s proprietary tracking with human-verified market inputs, providing both macro trends and detailed sector-level clarity.

It covers new energy investments, large-scale infrastructure rollouts, updated project pipelines and shifting procurement strategies—providing both high-level trends and sector-specific details

Designed for decision-makers and investors, the report helps you stay ahead of market changes, seize new opportunities and navigate Saudi Arabia’s complex project environment with confidence.

Who will benefit from the Saudi Giga Projects Market 2025 report?

- Investors

- Bankers

- Economists and analysts

- Oil and gas companies

- Oil, gas and chemicals traders

- Energy investors

- Oil services companies

- EPC contractors

- Construction companies and suppliers

- Manufacturers

- Engineering consultants

- Hotel investors

- PPP investors

- Power developers

- Technology companies

- Public Investment Fund (PIF)

- NEOM

- Red Sea Global

- Saudi Aramco

- SABIC

- ACWA Power

- Saudi Electricity Company (SEC)

- Saudi Water Partnership Company (SWPC)

- Bechtel

- Samsung C&T

- HSBC

What is unique about this report?

- MEED’s most comprehensive report on Saudi Arabia

- MEED’s unrivalled expertise and insight on the Middle East

- MEED Projects

- Focus on outlook for investment

All the MEED Insight reports are delivered via email in digital version.

Reviews

There are no reviews yet.