Description

Middle East & Africa Hydrogen Projects 2026

Middle East & Africa Hydrogen Projects 2026 delivers the most complete and forward-looking analysis of the region’s green, blue and low-carbon hydrogen and ammonia projects. Drawing on proprietary MEED Projects intelligence that has been quality-checked by MEED’s research team, this report offers clarity and accuracy not available through public sources or AI-generated content.

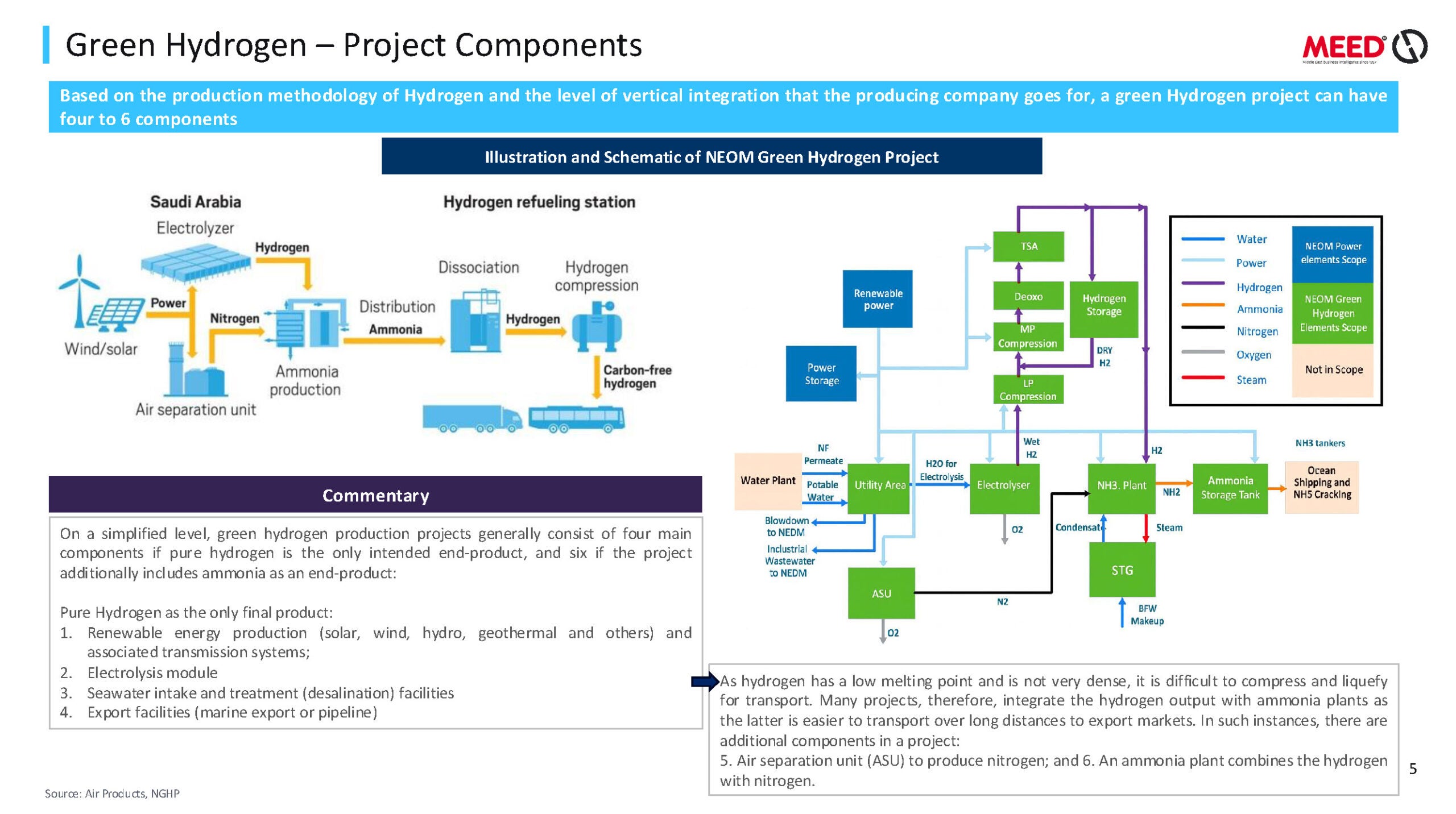

From giga-scale schemes like the NEOM Green Hydrogen Company project—the world’s largest and most advanced green hydrogen development—to Oman’s 25GW Intercontinental Energy complex and Egypt’s $10bn+ ACME hydrogen hub, this edition provides unmatched visibility into every major project shaping the MEA hydrogen economy.

This 400+ page report gives you unparalleled clarity on national hydrogen strategies, investment pipelines, developer activity, export pathways, procurement models and the long-term opportunities that will define the global hydrogen trade over the next decade.

What the report covers

Middle East & Africa Hydrogen Projects 2026 provides a full project-by-project assessment of the region’s hydrogen landscape, including:

- National hydrogen strategies across Saudi Arabia, UAE, Oman, Egypt, Morocco, South Africa and more

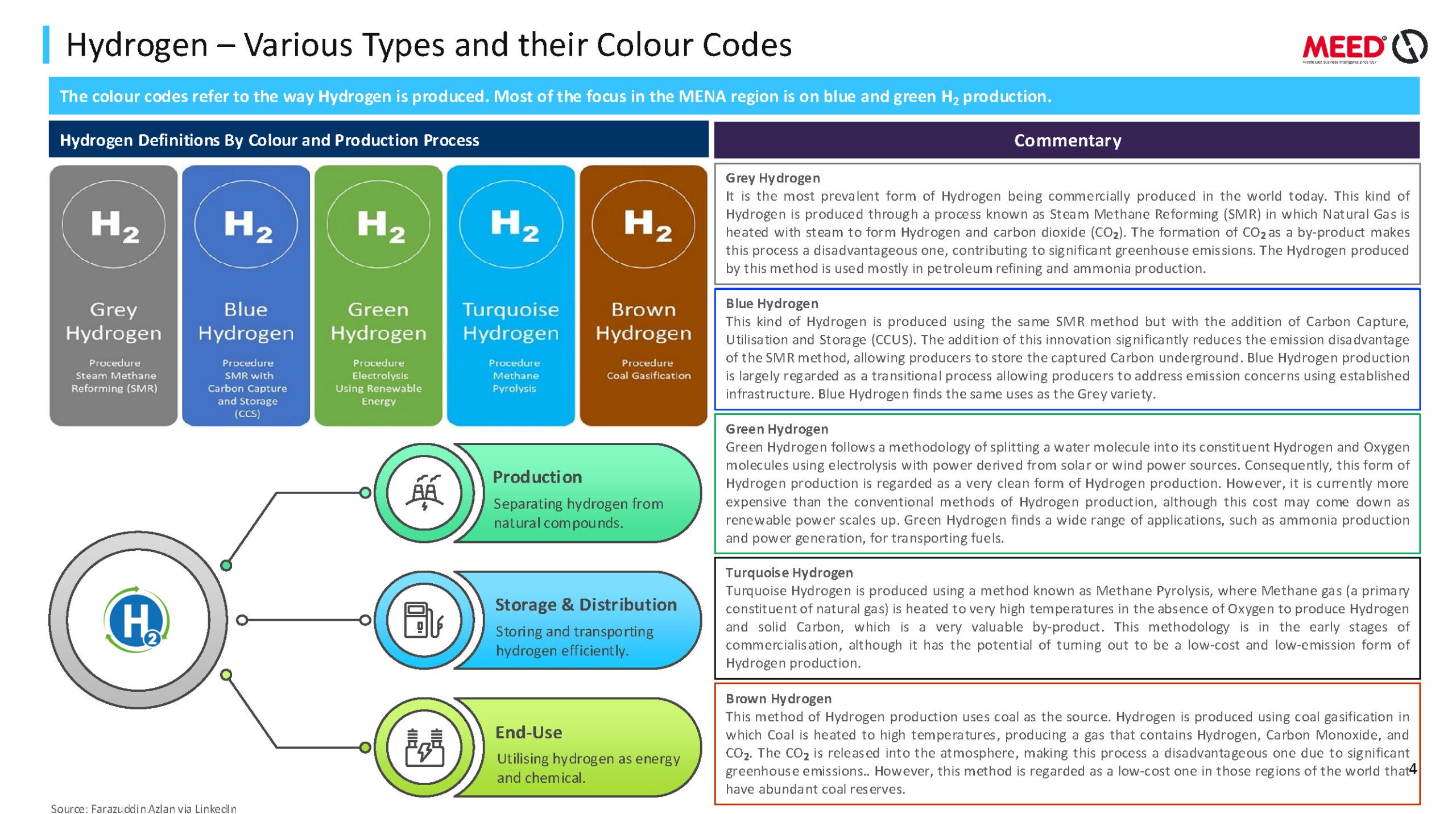

- Pipeline visibility across green hydrogen, blue hydrogen, ammonia, e-fuels and derivatives

- Key developers and stakeholders, including offtakers, utilities, EPCs and sovereign funds

- Regulatory frameworks, incentives and export potential to Europe and Asia

- Financing models, PPP structures, JV frameworks and localisation requirements

- Procurement opportunities, registration routes and prequalification details (where available)

Major projects analysed include

- NEOM Green Hydrogen

- Salalah Green Hydrogen and Ammonia Complex (OQ, ACWA Power, Air Products)

- PIF–POSCO Hydrogen Export Plant (Saudi Arabia)

- TAQA & AD Ports Green Ammonia Complex (UAE)

- Hyphen Hydrogen Energy (Namibia)

- CWP Global Aman (Mauritania)

- Globeleq Green Fuel Production Plant

Hydrogen as the new Energy frontier

The Middle East & Africa sit at the centre of a global energy transition as the world accelerates towards net-zero. Hydrogen—particularly green hydrogen produced via renewable energy—is becoming the backbone of new industrial strategies, export pathways, and decarbonisation plans:

- Saudi Arabia’s Vision 2030 hydrogen ambitions

- UAE’s Hydrogen Leadership Roadmap

- Oman’s Hydrom green hydrogen zones

- Egypt’s SCZONE hydrogen clusters

- Namibia, Morocco and South Africa’s export-focused programmes

These national visions are unlocking billions of dollars in sovereign investment and attracting the world’s most active hydrogen developers.

Market Challenges & Opportunities

The scale of MEA hydrogen development brings both opportunity and complexity, including:

- High CAPEX and evolving regulations

- Certification and export compliance requirements

- Land and water access constraints

- Renewable integration and storage challenges

- Technology scale-up risk and supply chain gaps

Governments are responding with structured procurement, land allocation, incentives and manufacturing localisation plans, creating new opportunities across engineering, offtake, EPC, supply and finance.

Opportunities for 2026 and beyond

A new wave of opportunities will emerge from:

- Green hydrogen-to-ammonia export complexes

- Hydrogen for steel, cement, refining and chemicals

- Hydrogen mobility and maritime bunkering

- Electrolyser manufacturing and renewable integration

This report provides the clearest roadmap to these opportunities, backed by human-validated MEED data.

Why does this report matter?

More than 45 hydrogen projects worth over $100bn have been announced in the past three years alone, but tracking their status, timelines, partners and procurement routes is increasingly complex. This 400+ page report provides a manually audited and research-validated overview, complete with detailed breakdowns of each project. It gives executives, strategists and business development teams a quick-reference, high-confidence tool to make better decisions, faster.

Advantages of the Middle East & Africa Hydrogen Projects 2026 report

- Converts complex regional dynamics into clear, visual and objective insights

- Connects macro trends—energy transition, decarbonisation, industrial policy—to micro-level project pipelines

- Maps procurement pathways and stakeholder influence to support targeted engagement

- Highlights key risks across regulation, finance, technology and supply chains

- Tracks the most active developers, investors, EPCs and offtakers to guide partnership strategies

Who will benefit from the MENA Transport Projects Market 2026 report?

- Hydrogen project developers and investors

- Bankers

- Financiers

- Energy ministries and government authorities

- Economists and analysts

- Sovereign wealth funds

- EPC contractors and engineering firms

- Renewable energy developers (solar, wind, hybrid systems)

- Financial institutions, banks, and export credit agencies

- Industrial offtakers (steel, ammonia, chemicals, refineries)

- Technology providers (electrolysers, turbines, storage, control systems)

- Utilities and transmission companies

- PPP investors and infrastructure funds

- Consulting firms and strategy advisers

- Academic institutions and research bodies

- ACWA Power

- Japan Bank for International Cooperation

- Masdar

- ENGIE

- Air Products

- Oman Hydrom

- Fortescue

- Siemens Energy

- Mitsubishi Power

- Linde

- Orascom Construction

- Techint Engineering & Construction

- Iberdrola

What is unique about this report?

The 2026 edition represents a major upgrade in scope and depth:

- Expanded project pipeline reflecting record-level 2024–2025 announcements

- Updated national strategies and regulatory frameworks

- New mapping of export corridors and certification systems

- Enhanced insights on local manufacturing and supply chain potential

- Significantly expanded African market coverage

What makes MEED’s data different

This report is built on MEED Projects, the region’s most trusted and longest-running projects database. Every data point is:

- Human-validated

- Independently verified

- Unavailable on any open-source platform

- Not accessible through AI models like ChatGPT

- Trusted by governments, EPCs, developers and global investors

This is real project intelligence, not scraped data or automated summaries.

All the MEED Insight reports are delivered via email in digital version.

Reviews

There are no reviews yet.