Description

The GCC Data Centre Projects Market 2026

Data Centres at the Core of the GCC’s Digital Economy

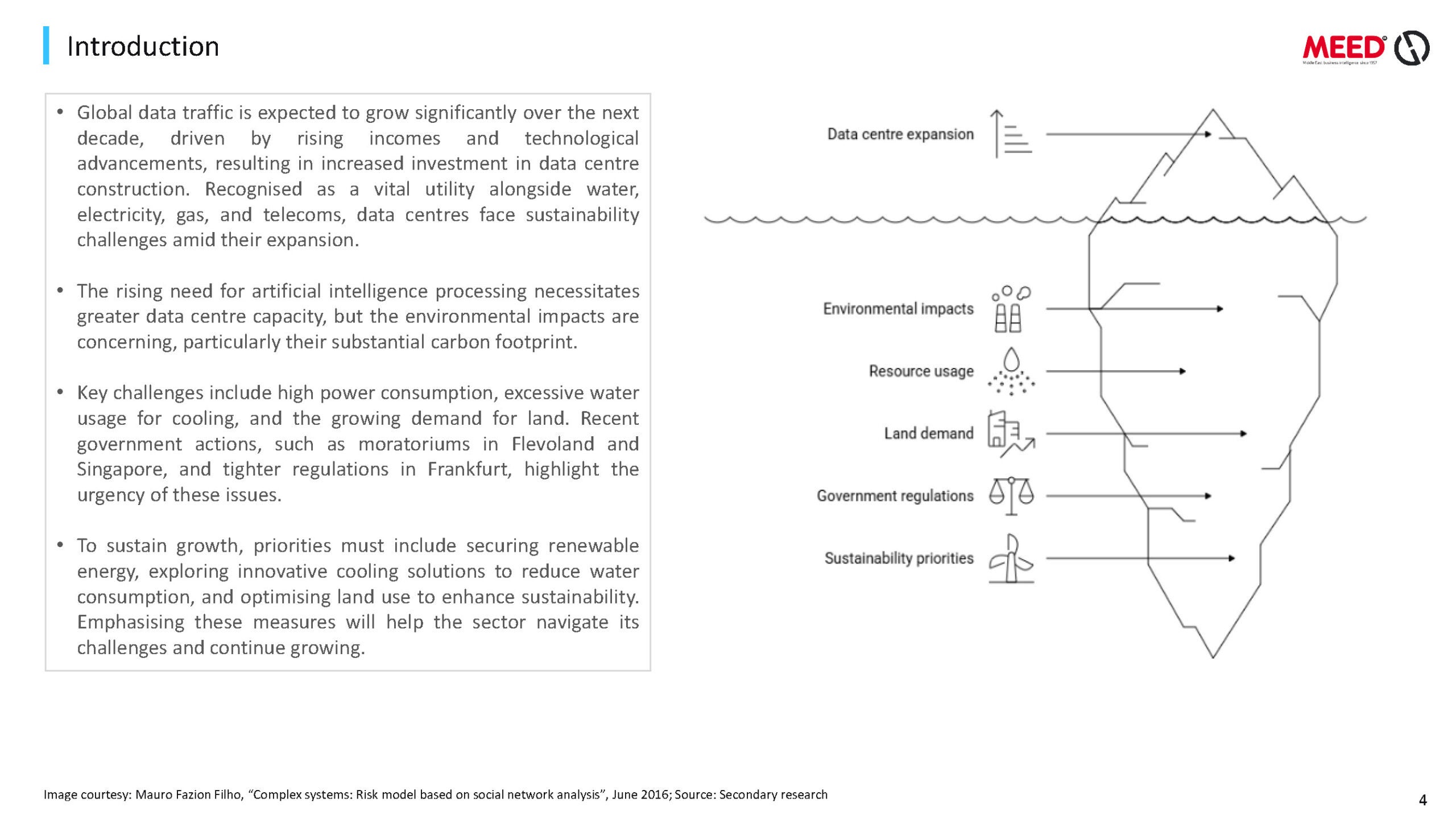

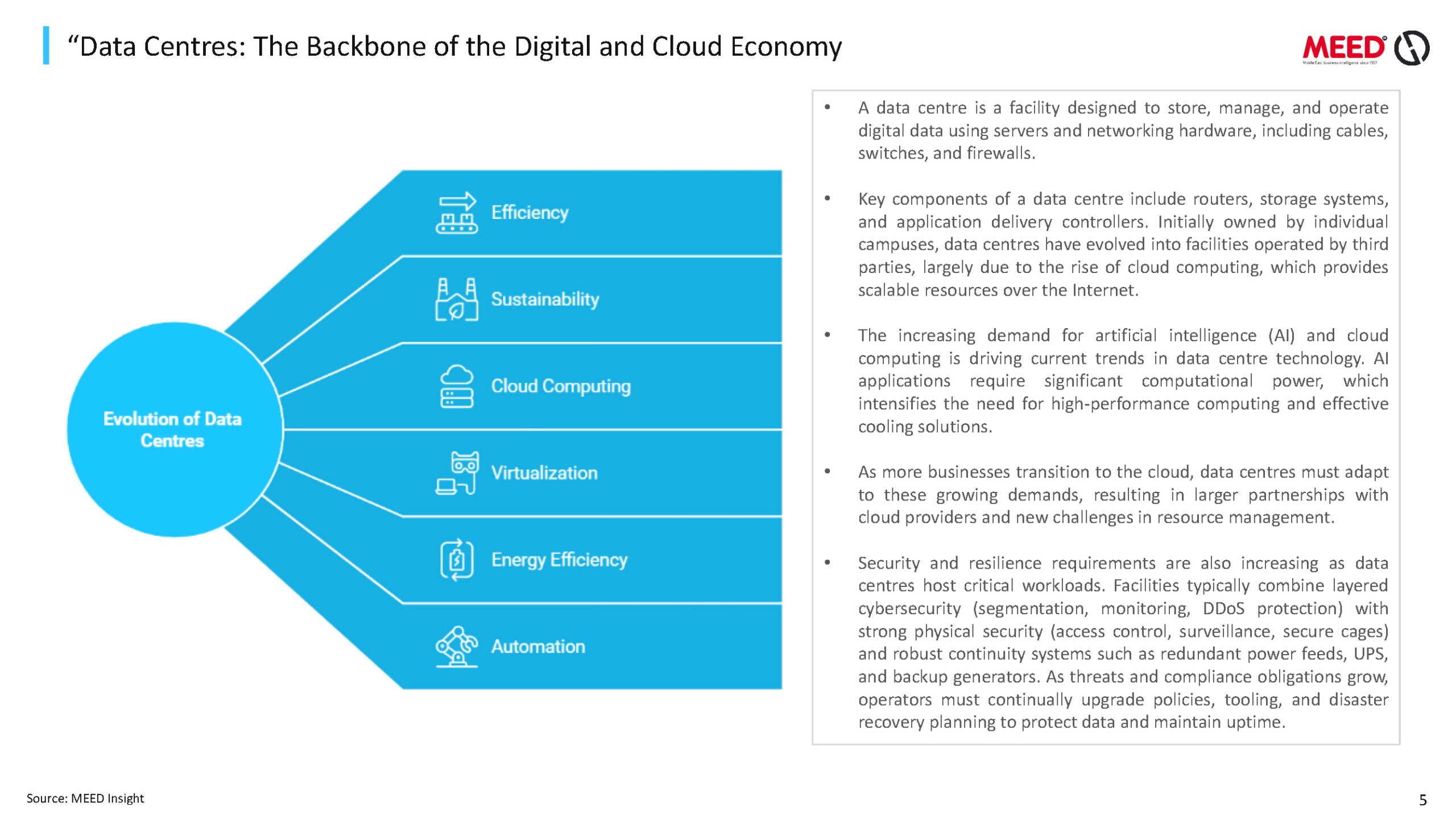

Data centres are now core infrastructure for the GCC’s digital economy. They underpin cloud computing, AI workloads, fintech platforms, e-government services, smart cities and cybersecurity resilience.

Demand is accelerating as governments push data localisation, hyperscalers expand regional capacity and power-intensive AI applications reshape infrastructure requirements.

- Saudi Arabia and the UAE are leading growth through hyperscale campuses, sovereign cloud initiatives and large-scale data centre clusters

- Qatar, Oman, Bahrain and Kuwait are strengthening in-country hosting and regional connectivity

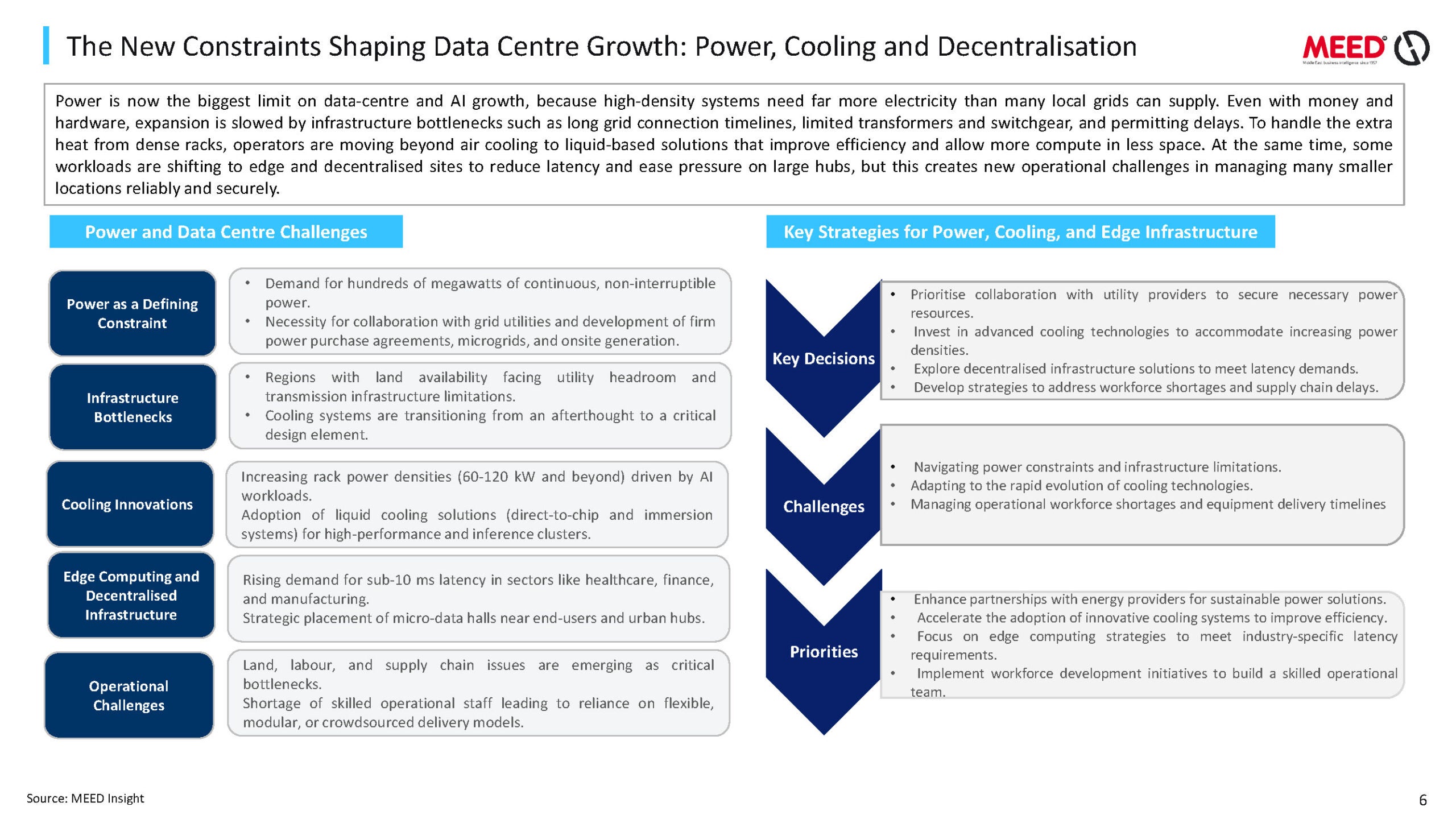

- Power availability, grid capacity, cooling efficiency and ESG compliance are emerging as defining market constraints

Alignment with national digital strategies

Data centre development is closely tied to national policy and long-term digital agendas, including:

- Saudi Arabia’s Vision 2030 and digital transformation programmes

- UAE digital economy and AI strategies

- Smart city, cloud-first and localisation policies across the wider GCC

These initiatives are translating into sustained demand for high-capacity, energy-efficient and resilient data centre infrastructure, supported by public-private partnerships and strategic alliances.

Key regional priorities include:

- Hyperscale and colocation facilities for global cloud providers

- Edge data centres enabling 5G, IoT and low-latency services

- Advanced cooling, modular construction and renewable energy integration

- Partnerships between hyperscalers, local developers, utilities and government entities

Market scale, opportunities and risks

The GCC data centre pipeline is deep, active and competitive.

- More than a dozen projects valued above $100m are currently under tender

- Additional packages are expected to reach the market within the next 6–12 months

- Major global players such as AWS, Google and Huawei are active alongside regional leaders including Khazna, Moro and Gulf Data Hub

However, rapid growth is also creating delivery and execution challenges. Constraints around power supply, land availability, contractor capacity and sustainability requirements are reshaping procurement strategies and project timelines.

This report highlights where risks exist, where opportunities are emerging and which projects are genuinely moving forward, not just announced.

How does this report help you?

The GCC Data Centre Projects Market 2026 is designed for decision-makers who need clarity in a complex and fast-moving market.

The report enables you to:

- Identify high-value opportunities before they become crowded

- Track live project pipelines and capacity expansion timelines

- Understand procurement models, phasing strategies and contract structures

- Assess delivery risks linked to power, cooling, ESG and supply chains

- Prioritise markets, clients and partners with greater confidence

- Strengthen forecasting, bidding and market entry strategies

All insights are grounded in project-level intelligence verified by MEED’s research team, not desk-based assumptions.

What makes the GCC Data Centre Projects Market 2026 different?

This is not a static project list.

The GCC Data Centre Projects Market 2026 combines:

- Proprietary MEED Projects data covering live and future projects

- Continuous market tracking by MEED’s regional analysts

- Insight into under-the-radar developments and early-stage pipelines

- Clear links between national policy, investment drivers and real projects

- Practical analysis focused on commercial decision-making

The result is actionable intelligence that supports strategy, business development and risk management.

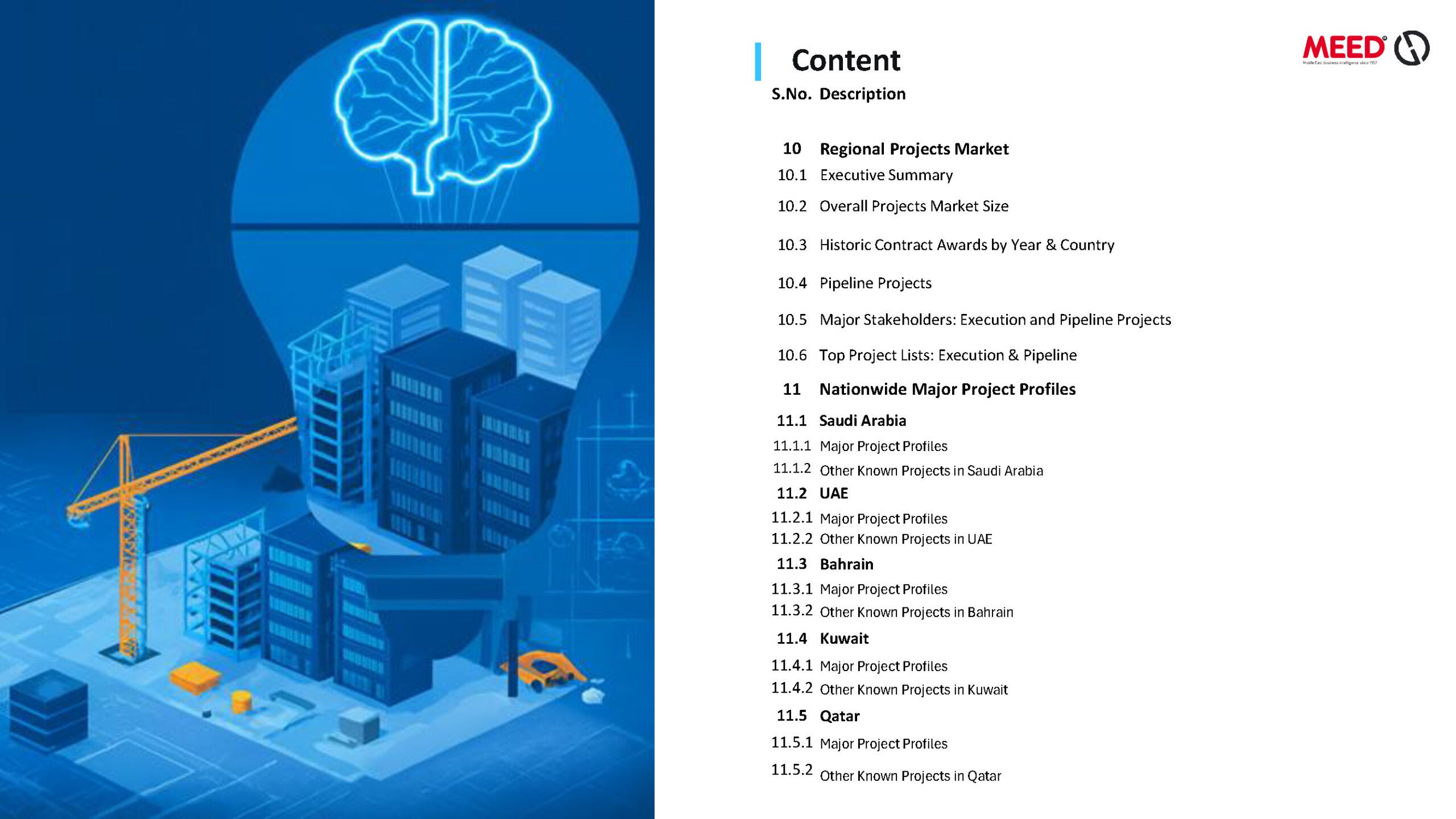

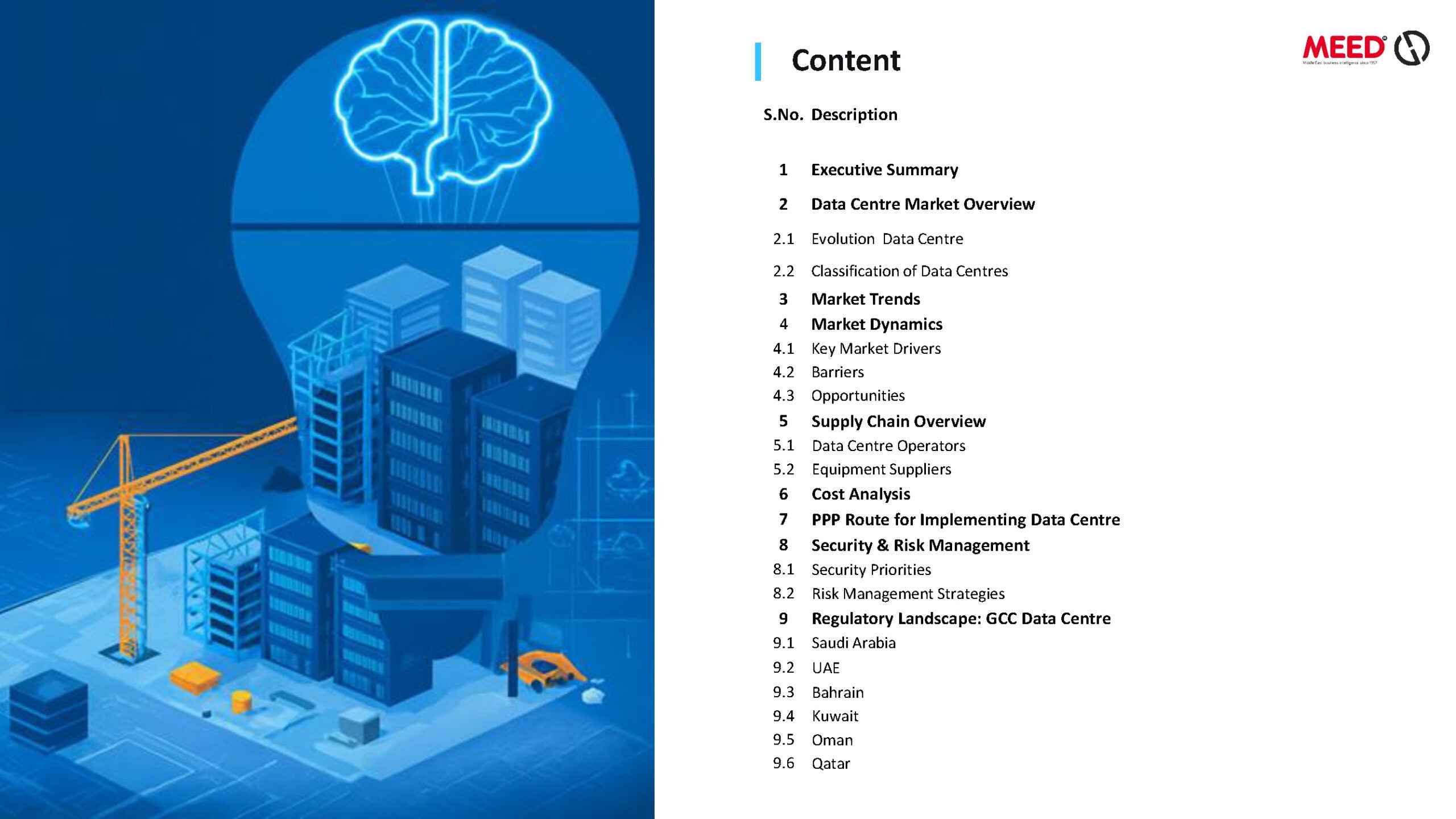

Key topics covered

- GCC data centre project pipelines by country and project type

- Investment outlook, capex trends and client spending plans

- Hyperscale, colocation, enterprise and edge facilities

- Procurement routes, packaging strategies and delivery models

- Power and cooling technologies, energy efficiency and ESG considerations

- Renewable integration and sustainability requirements

- Regulatory frameworks and localisation policies

- Profiles of key developers, hyperscalers, contractors and suppliers

Who will benefit from the GCC Data Centre Projects Market 2026 report?

- Contractors

- Data centre developers

- Suppliers

- Investors, infrastructure funds and Bankers

- Economists and analysts

- Policy makers

- Manufacturers

- Engineering consultants

- Investors

- Technology companies

- Academics

- Researchers

- Power and cooling technology suppliers

- Digital infrastructure firms

- Saudi Telecom Company

- Khazna Data Centers

- Gulf Data Hub

- Moro Hub

- Equinix

- Edgnex

- Schneider Electric

- Vertiv

- Siemens

- Johnson Controls

- AECOM

- Arup

- Horizons Contracting Co

- BK Gulf LLC

- ACWA Power

- Procore

- Watts Industries Middle East FZE

- Korea Plant Industries Association

- SEPCO

- AVK Gulf

- Atco Group

All the MEED Insight reports are delivered via email in digital version.

BASANTA KUMAR SAHU –

THANKS A LOT FOR THE VALUABLE INFORMATIONS