Description

The MENA Hydrocarbon & Power Projects Market 2024 Report

The MENA Hydrocarbon & Power Projects Market 2024 Report is the latest research report from MEED and is the most authoritative analysis of its type. It is of high value to government decision makers, developers, investors, contractors, consultants, and manufacturers in the Middle East oil, gas and power market.

Covering 14 countries, the report provides a complete and detailed country-by-country analysis of the oil, gas and power sectors in the Middle East and North Africa

It highlights and analyses specific project opportunities and tenders in each country, historical, current and future contract awards, and highlights the top contractors and clients. It also analyses the top contractors and clients, provides details of current and future tender opportunities, and quantifies the historical, current and future projects market by country and subsector.

Included in MENA Hydrocarbon & Power Projects Market 2024 Report:

- The MENA oil, gas and power sectors in each of the 14 countries covered in the region

- Comprehensive review of Middle East oil, gas and power projects market trends, opportunities and challenges

- Short and long-term pipelines outlooks for each market and subsector

- Detailed analysis of oil, gas and power plans in 14 MENA markets

- A proprietary construction risk index that outlines and compares specific risks by market

- Provides strategic approaches to winning work in the region

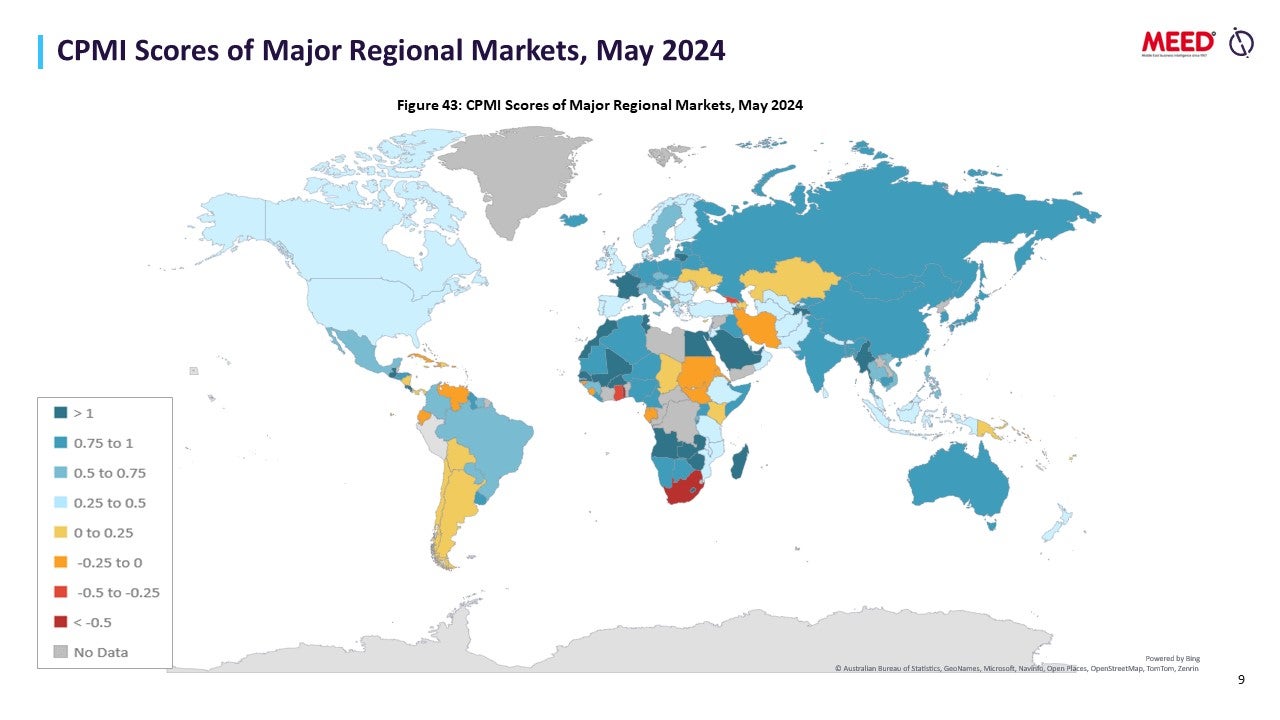

- A proprietary construction confidence momentum index that provides additional insight on the health of each market

- Detailed macroeconomic overview of each country with key metrics that impact project activity

- Tables of major current and future tenders and projects

- Rankings of the top contractors and clients

- Market sizing by cash flow, contract awards and our proprietary construction output data

Exclusively from MEED, The MENA Hydrocarbon & Power Projects Market 2024 Report is the authoritative go-to report for government decision makers, developers, investors, contractors, consultants, and manufacturers in the Middle East power sector.

Record year propels hydrocarbons and power projects market growth

The projects market in the MENA region smashed all records in 2023. Propelled by record spending levels from ADNOC, Saudi Aramco, and QatarEnergy, the region has never seen such a spate of activity.

In the GCC alone, contract awards hit an all-time record of $223bn last year, almost 40% up on the previous high, with both the UAE and Saudi Arabia having their best ever years.

As the market booms, companies globally are entering the region to take advantage of the diverse and huge opportunities available. Because of the intense competition for resources, project clients are reaching out beyond the region to attract projects firms to their project programs.

In parallel, contractual terms are becoming more flexible to attract contractors and suppliers, with the emergence of relatively novel procurement models such as early contractor involvement (ECI), advanced packaging, and FEED+EPC competitions.

The market outlook is likely to be prevalent for some time to come. The GCC alone has an astonishing projects pipeline in excess of $2.9 trillion, with Saudi Arabia comprising more than $1.5 trillion of this total.

The need to increase and maintain surge production capacities, the desire to maximise the hydrocarbons value chain and the strong growth in electricity demand and the rise in renewable energy are all factors driving this rapid project expansion.

Also key are specific megaprojects like the estimated $16bn Hail and Ghasa sour gas field development in Abu Dhabi, Qatar’s expansion of its LNG production capacity to 127 million tonnes a year, and Saudi Arabia’s $25bn third phase master gas system and Jafurah unconventional resources programs.

On the power side, Saudi Arabia’s fast track and ambitious renewable energy program combined with trends for new waste to energy and nuclear capacity plus the region’s increasing investments regionally in transmission and distribution projects are also critical drivers for increased capital expenditure.

But with this surge in project activity comes challenges. Cost inflation, logistical bottlenecks, labour and engineering shortages, and delays in the procurement of materials and equipment are all issues that companies need to understand, prepare for and overcome.

Energy security

Putting these opportunities and challenges into context and perspective is at the core of The MENA Hydrocarbon & Power Projects Market 2024 Report. Not only does it quantify the size of the market opportunity with MEED’s exclusive details on specific projects and tenders, it also outlines how companies can navigate market complexities and makes it simple for anyone interested in the market to create a strategy and budget.

The MENA Hydrocarbon & Power Projects Market 2024 Report is a new, comprehensive country-by-country review of the MENA hydrocarbon and power projects sectors and subsectors with in-depth analysis of project spending, risks, projected investment levels, and individual country short and long-term pipelines and plans.

Key facts and topics in The MENA Hydrocarbon & Power Projects Market 2024 Report:

- Historical, current and future contract awards by country and subsector

- Top contractors and clients

- Alternative market sizing metrics with the propriety construction output model

- Details of current and future tenders

- Quantifies the size of the projects pipeline in each market and subsector

- Key risk, confidence and macroeconomic data

- Main drivers behind the region’s record projects performance

- Key opportunities and the context behind them

- Analysis of hydrocarbons and power project spending plans across 14 markets in the region, including: Algeria, Bahrain, Egypt, Iraq, Jordan, Kuwait, Morocco, Oman, Qatar, Saudi Arabia, Tunisia and the UAE

- Explains the structure of the oil, gas and power sectors

- Details the main projects due to be awarded in 2024 and beyond

- Identifies risks and opportunities

Who will benefit from The MENA Hydrocarbon & Power Projects Market 2024 Report?

- Main, general and EPC contractors

- MEP subcontractors

- Piling contractors

- Key materials and equipment suppliers

- Economists and analysts

- Policy makers

- Project sponsor such as real estate developers and infrastructure clients

- Engineering consultants

- Manufacturers and distributors

- Financial and technical advisers

- Law firms

- Financial institutions

- Technology companies

- Academics

- Researchers

- Saudi Aramco

- ADNOC

- QatarEnergy

- Kuwait Petroleum Corporation (KPC) & affiliates (Kuwait Oil Company, KNPC)

- ACWA Power

- Saudi Electricity Company (SEC)

- Masdar

- Ministry of Electricity & Renewable Energy

- ONEE

- Ma’aden

How is this report different from others in the market?

- A brand new report covering some of the world’s fastest growing and most dynamic power and oil and gas projects markets

- In PowerPoint format for ease of use and understanding

- Focus on contracts, tenders and projects using the MEED Projects proprietary database of all known projects in the region worth more than $10m

- The complete and authoritative reference tool for anyone interested in the MENA projects market

What is unique about this report?

- MEED’s unrivalled expertise and insight on the Middle East

- MEED Projects data

- Focus on the outlook for investment

All the MEED Insight reports are delivered via email in digital version.

Reviews

There are no reviews yet.