Description

Libya Oil & Gas 2023

The latest premium market report from MEED, the leading provider of Middle East business intelligence.

The report provides a detailed analysis of the project trends opportunities and challenges in a market that will be represent one of the fast-growing oil and gas market opportunities over the short and medium terms.

Libya Oil & Gas 2023 examines the structure of the Libyan oil and gas industry and provides details of some of the current and future project plans as the country emerges from a period of turbulence and starts to increase capital expenditure.

The 200-plus page report includes dozens of project profiles, tenders, asset maps, and key data on upstream and downstream assets such as current and planned capacity

Libyan Oil and Gas Market Opens Up

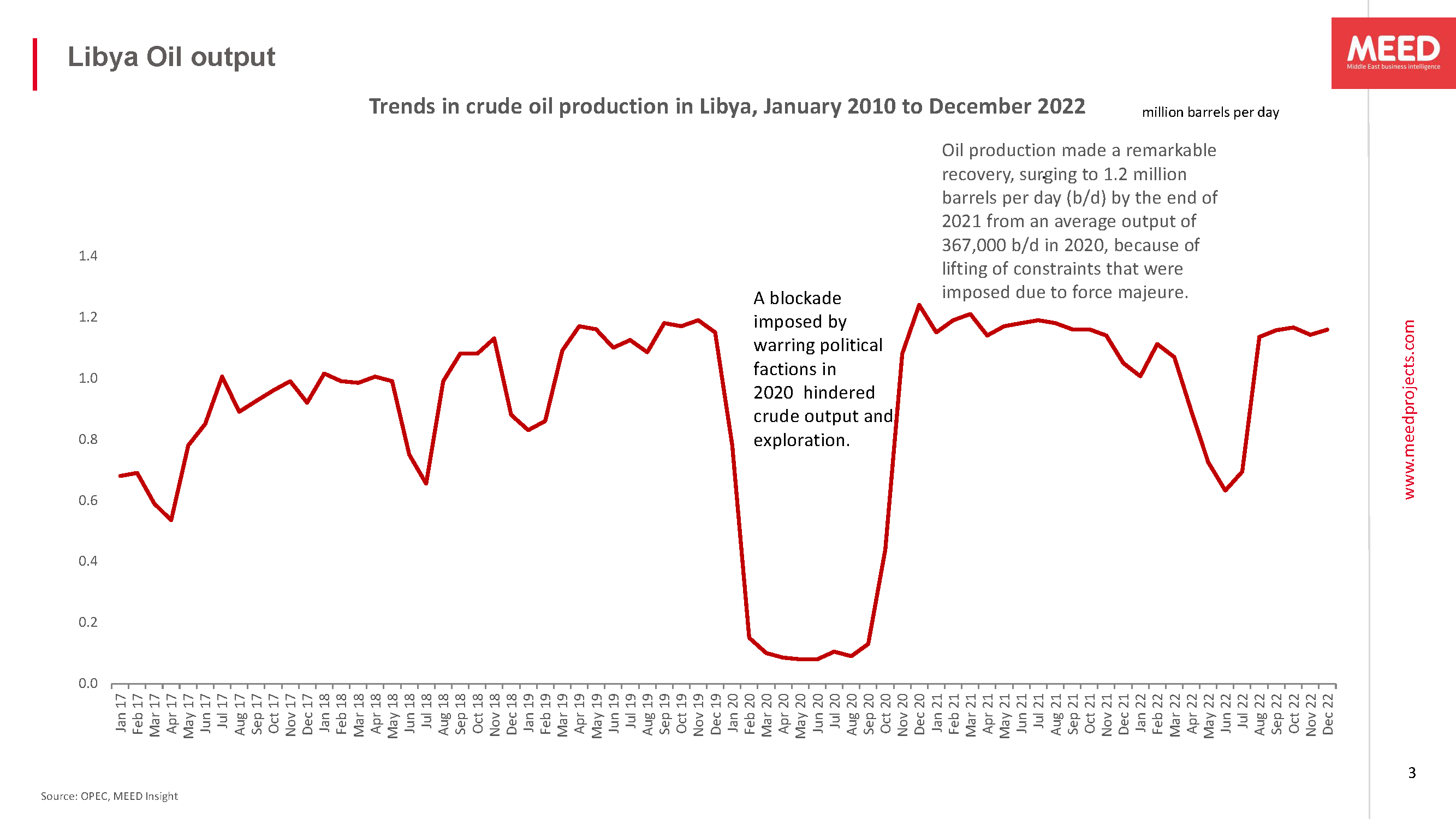

The award of the contract to help develop a new $1.6bn refinery in southern Libya in March 2023 is a significant step in the renewed and much-need development of the country’s oil and gas sector following years of political upheaval.

With demand continuing to grow and oil prices sitting at more than $80 a barrel, there is a greater incentive than ever for Libya to expand production capacity and tap into its estimated 48.4 billion barrels of proven oil reserves and 1.5 trillion cubic meters of natural gas reserves.

The work required is immense. After years of sanctions and then civil war, Libya’s oil and gas infrastructure is dated and operating at well below capacity. Huge investment is needed to rehabilitate upstream and downstream assets as well as develop new fields and export facilities.

In recent months a number of new project tenders have been launched. Zallaf, a subsidiary of the National Oil Corporation (NOC) is developing three new fields in the south and the associated export pipelines as well as the new refinery.

Offshore, Mellitah Oil and Gas, a joint venture between ENI and NOC, is proceeding with its plans to develop its Bouri gas field, while there are also moves for the North Gialo field development, multiple new water disposal and injection schemes, and pipeline upgrades.

With demand for oil and gas higher than ever in Europe as the Russia market collapses, there has never been a greater incentive for Libya to ramp up output from the 1 million barrels a day average today to the 3 million barrels it produced in the past. But doing say we require investment in the tens of billions of dollars.

Challenges

This will not necessarily be easy given the ongoing civil impasse between the east and west of the country. However, there is a much greater degree of stability today and a consensus that Libya needs to and can increase its hydrocarbons output for all.

Who will benefit from the Libya Oil & Gas 2023 report:

- Contractors

- Investors

- Bankers

- Economists and analysts

- Oil and gas companies

- Oil, gas and chemicals traders

- Energy investors

- Oil services companies

- EPC contractors

- Construction companies and suppliers

- Manufacturers

- Engineering consultants

What is unique about Libya Oil & Gas 2023 report?

- Helps you to make the most of the opportunities in one of the world’s largest potential oil and gas projects markets.

- It also contains profiles of each of the operating companies along with their procurement processes and key contacts.

- It informs strategy.

- Identifies new and potential opportunities.

- Highlights challenges in the market.

- Helps you minimise risk.

- All the MEED Insight reports are delivered via email in digital version.

All the MEED Insight reports are delivered via email in digital version.

Reviews

There are no reviews yet.