Description

MENA Transport Projects Market 2026

Unlock the future of the Middle East and North Africa’s most dynamic infrastructure sector with the MENA Transport Projects Market 2026.

Using MEED’s exclusive project intelligence and analyst-validated market data, the report covers railways, metros, airports and ports and the impact of digitalisation, decarbonisation, multimodal connectivity and PPP delivery models, equipping stakeholders to identify opportunities, manage risks, and craft effective transport strategies across MENA in 2025 and beyond.

Transport connectivity at the heart of MENA’s transformation

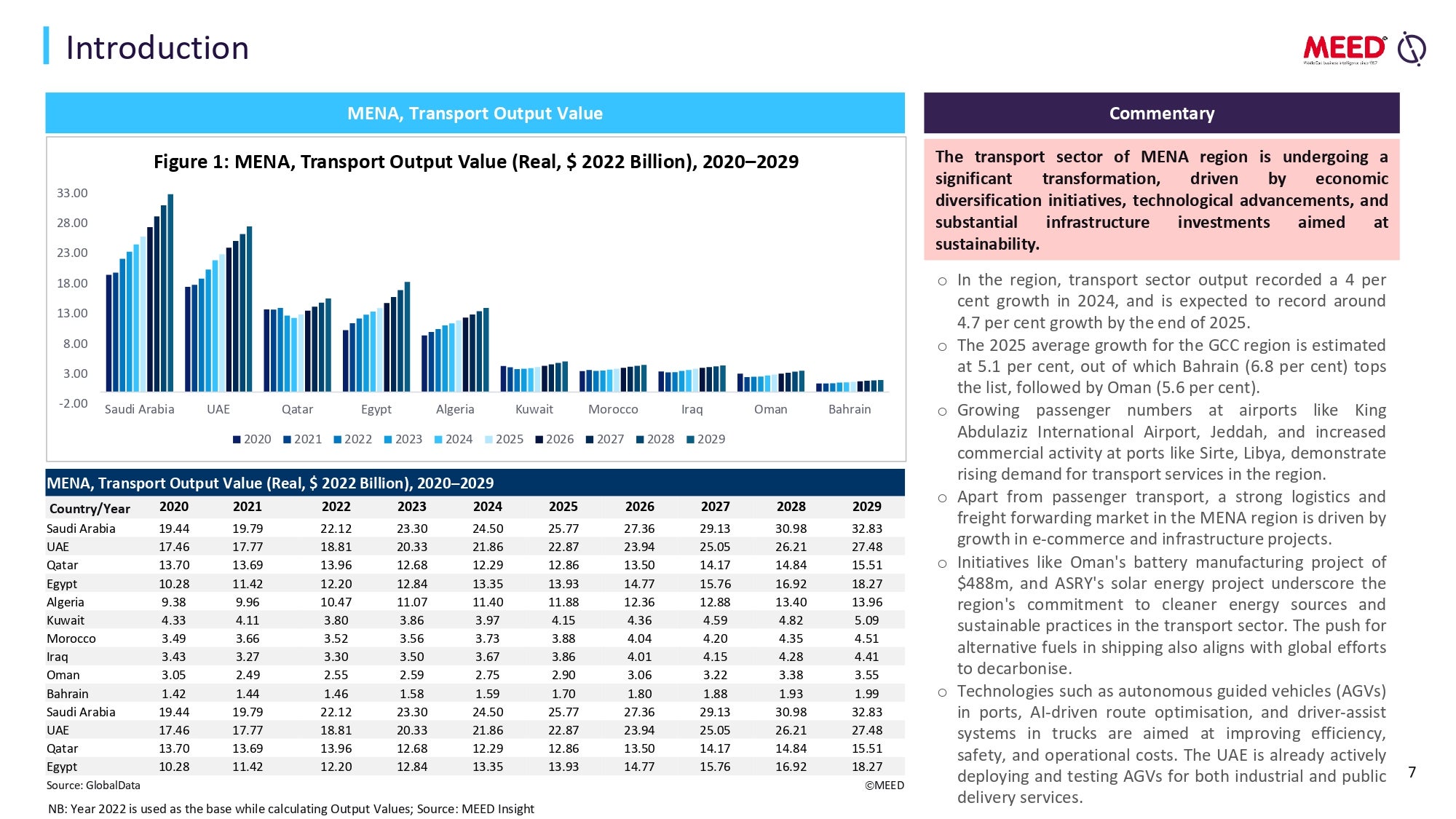

Transport infrastructure is now a strategic driver of national transformation. Rising populations, rapid urbanisation and economic diversification are prompting governments to invest at unprecedented scale in railways, metros, airports and ports, unlocking mobility, trade and regional integration.

Acceleration of national visions and sustainability agendas

Landmark programmes like Saudi Arabia’s Vision 2030, UAE’s National Transport and Logistics Strategy, and Qatar National Vision 2030 place transport megaprojects at the core of national growth. From giga-scale rail networks to next-generation airport terminals and smart port ecosystems, MENA governments are redefining financing, procurement and delivery of infrastructure.

MENA Transport Projects Market 2026 equips you with intelligence on:

- Airport expansions and terminal upgrades

- Port infrastructure, logistics zones and trade corridor developments

- PPP opportunities across rail, aviation and maritime (EPC, DBOM, concession)

- Key clients, developers and contractor profiles across transport modes

- Investment drivers, policy alignment and regulatory reforms

- Risks, financing structures and privatisation trends shaping project delivery

Sector momentum and pipeline

- In 2025, over $7bn in transport contracts awarded, building on $17.4bn in 2024.

- Combined rail, metro, tram and LRT pipeline exceeds $299bn; adding ports and airports brings total planned projects to over $470bn.

Key government-driven programmes

- Multi-billion-dollar rail initiatives: GCC Railway, Etihad Rail, Egypt’s high-speed network

- Airport expansions: Riyadh King Salman International, Dubai Al Maktoum, Doha Hamad Phase 2

- Port upgrades and logistics hubs: King Abdullah Port, Duqm, Jebel Ali automation

- PPP frameworks across EPC, DBOM, and concession models

- Sustainability integration: electrified rail, green aviation, port decarbonisation

- PPP frameworks across transport modes, enabling private capital participation in EPC, DBOM, and concession models

- Integration with sustainability goals—electrified rail, green aviation, and port decarbonisation

Delivery challenges and strategic shifts

Transport projects face complex risks:

- Cost inflation and financial volatility

- Supply chain disruptions and material pricing pressures

- Technology integration: digital twins, AI-driven traffic systems, smart logistics

- Workforce constraints and localisation mandates

Governments are responding with restructured procurement, international partnerships and enhanced developer/contractor frameworks.

Emerging opportunities in 2026 and beyond

The next wave of transport infrastructure will be shaped by:

- High-speed rail corridors and cross-border connectivity (UAE-Oman Hafeet Rail, Kuwait-Riyadh, Qatar-Saudi)

- Airport modernisation and intermodal hubs linked to metro and rail systems

- Port digitisation, automation and integration with free zones and logistics cities

- Deployment of smart mobility technologies to reduce congestion and emissions

- Green hydrogen and electrified transport corridors are driving new infrastructure demand

With project agreements spanning 20–30 years, off-takers and investors are seeking optimal deals that balance cost, sustainability and innovation—offering long-term stability for market entrants.

What are the advantages of the MENA Transport Projects Market 2026 report?

Advantages

- Clear, data-rich visuals simplifying complex market dynamics

- Visibility across short-term contracts and long-term opportunities

- Connects macro drivers (regional integration, decarbonisation, privatisation) with micro-level intelligence (timelines, budgets, procurement)

- Identifies constraints, cost pressures and EPC bottlenecks for proactive planning

- Tracks active investors, contractors and off-takers for strategy alignment

- Includes human-verified project data you can’t find anywhere else

Features

- 500+ pages of analysis, 200+ charts, tables, maps and timelines

- Detailed coverage of rail, metro, tram, airport and port projects in 12 MENA markets

- Listings of planned, in-development and execution-phase projects (2025–2027)

- Country-specific policy, PPP frameworks, client priorities and regulatory updates

- Proprietary MEED Projects data, developer rankings and market structure insights

- Delivered digitally in PowerPoint for easy reference and integration

Key topics covered in the MENA Transport Projects Market 2026 report

- Full MENA regional coverage: rail, metro, tram, airport, and port infrastructure across 12 markets (Saudi Arabia, UAE, Qatar, Oman, Kuwait, Bahrain, Egypt, Iraq, Jordan, Morocco, Algeria, Tunisia)

- Government priorities on connectivity, trade facilitation, and private participation via PPPs

- Detailed project pipeline, from pre-execution to tendering, enabling targeted opportunity identification

- Market structure and stakeholder insights: developers, operators, EPC contractors, procurement intelligence

- Policy shifts in procurement, localisation, and decarbonisation initiatives

- Innovation and sustainability: digital twins, smart mobility, solar PV, multimodal logistics hubs

- Forward-looking trends: regional integration, congestion mitigation, investment response to climate imperatives

- Exclusive MEED Projects data for high-confidence strategy, investment, and business development

What makes this report different from others in the market?

MENA Transport Projects Market 2026 provides an unmatched intelligence upgrade, combining exclusive data, fresh analysis and strategic insight across one of the region’s fastest-growing sectors.

From high-speed rail corridors to airport hub transformations, the report delivers:

- Comprehensive pipeline visibility

- Client strategy and procurement trends

- Landmark projects and financing models

- Sustainability drivers: electrification, decarbonisation, digital mobility platforms

Packed with 400+ pages of proprietary MEED Projects data, charts, and project listings, it is essential for developers, contractors, suppliers, financiers, and policymakers navigating the complex, opportunity-rich MENA transport market.

Who will benefit from the MENA Transport Projects Market 2026 report?

- Transport Infrastructure sector investors and developers

- Financiers

- Bankers

- Economists and analysts

- Policy makers

- Legislators

- Contractors

- Construction companies and suppliers

- Manufacturers

- Engineering consultants

- PPP investors

- Academics

- Researchers

- Orascom Construction

- The Arab Contractors

- Cosider Groupe

- Alstom

- Shibh Al Jazira Contracting

- FCC Construction

- COLAS

- Bombardier

- Hassan Allam Construction

- China State Construction Engineering Corporation

What is unique about this report?

- MEED’s most comprehensive report on the Transport Infrastructure projects market

- MEED’s unrivalled expertise and insight on the Middle East

- MEED Projects data

- Focus on the outlook for investment

All the MEED Insight reports are delivered via email in digital version.

Reviews

There are no reviews yet.